Families and Teachers Working Together for School Banks Summary

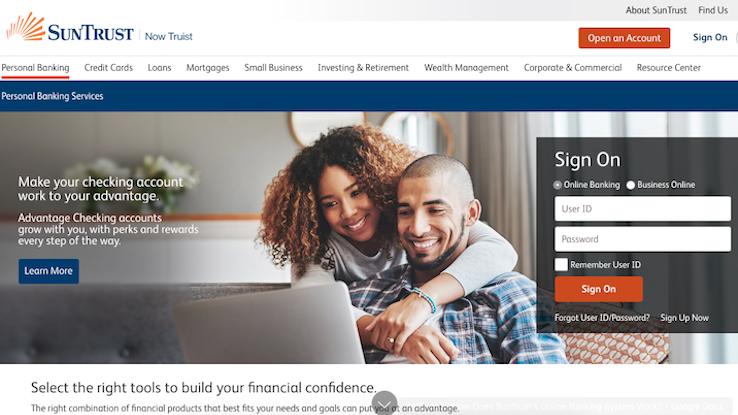

SunTrust's online banking system works in much the same way equally other banks' systems exercise. Using SunTrust'south digital cyberbanking platform, account holders who sign up for the service tin can view and manage their accounts over the internet using a calculator or a mobile device. You can pay bills, transfer funds, prepare balance alerts and access credit card options.

Depending on the type of account you take with SunTrust, yous'll also have admission to your checking account, savings account, certificate of deposit account, credit cards, individual retirement accounts (IRAs), mortgage, lines of credit and installment loans — all on a single page one time you log into SunTrust'southward online cyberbanking portal. Acquire more about the platform's functionality to brand the virtually of your online banking experience.

One of the primary conveniences of online banking is that it gives you a way to pay bills without having to leave abode — or to do so on the become using a mobile device. It's simple and like shooting fish in a barrel, so it comes as no surprise that data show Americans pay approximately 56% of their bills online.

SunTrust'due south online bill-payment portal incorporates several features that brand the process of setting up payments easier. You can prepare up periodic and regular reminders to pay bills and actuate alerts on your payment dates. One-time or recurring automatic pay options are available, and y'all can too customize the amount and frequency of each payment.

Another bill-payment characteristic the depository financial institution offers is eBill. Using this service, you tin opt to receive some types of bills electronically and besides receive alerts for paying these bills via emails and the online banking app when the due dates are approaching. This can assistance you track and manage both your payments and your upkeep more than efficiently in one place using the banking company's online portal.

SunTrust clients do take to enroll their accounts earlier they can use the company's online banking services. When enrolling via SunTrust's online cyberbanking portal, you should take your business relationship number, ZIP code and the final four digits of your Social Security number on hand and ready to provide when prompted.

Can You Make Internal Payments and Funds Transfers?

SunTrust clients who concur several account types volition find it user-friendly and efficient to transfer funds between their accounts online. You can complete internal payments, such equally those for SunTrust loans and credit cards, using the online cyberbanking app. Equally with pecker payments, you tin choose and schedule payment dates that work best for you, such every bit a few days after your payday.

You can likewise use SunTrust'south online cyberbanking organization to transfer funds to or from other U.Due south. financial institutions. Transferring money into a SunTrust account is free, while transferring funds from SunTrust accounts to other banks may incur some fees, depending on the other banks' policies.

SunTrust'due south online system likewise allows you lot to send, receive and request payments to and from another person who holds a U.South. bank account. This service is available if you've enrolled your e-mail address or mobile number with Zelle payment services, which is a payment network that'south similar to Venmo and other digital money-transfer apps. While there are some limits to Zelle transactions, such as $500 weekly limits in certain circumstances, payments and transfers utilizing this system usually process within minutes.

How Secure Is SunTrust'southward Online Banking?

Although online banking provides user-friendly solutions for various services, it also comes with risks — like threats from cybercriminals. Depository financial institution fraud has gone digital, courtesy of hackers who are always on the lookout for means to digitally exploit banking systems. Rather than break into a banking company'south ain online organization, nevertheless, virtually hackers prefer to focus on individual banking clients and mobile banking app users, who are typically easier targets because they have less-secure devices and accounts.

On its website, SunTrust reminds users of some of its security practices, including that information technology doesn't send out emails or text messages to its clients to ask for sensitive information. One of the well-nigh common tricks hackers utilise is to transport official-looking emails or text messages to individuals, frequently with alarming letters to fob them into disclosing confidential information or opening links that install viruses.

This information, which typically includes passwords, Social Security numbers and credit bill of fare numbers, is often all that the hackers need to break into an individual's banking concern account and steal coin. SunTrust encourages its clients to be cautious about such emails and play an agile function in stopping banking concern fraud against themselves before it starts.

The bank likewise shares a security checklist with tips you can utilize to fortify security on your own accounts on various devices. Included in the checklist are measures you should utilize to protect your information and online banking profile, such every bit using complex usernames and passwords, enabling activity alerts, opting for paperless transactions and using a gratuitous identity theft-protection app.

Source: https://www.askmoney.com/credit-cards/using-suntrust-online-banking-system?utm_content=params%3Ao%3D1465803%26ad%3DdirN%26qo%3DserpIndex